Adaptive Filter Strategy Pack

Master the Market’s Hidden Structure with Adaptive Signal ProcessingOverview

This professional-grade pack features 10 advanced adaptive filter strategies for Python systematic trading. Every strategy is engineered to dynamically adjust to market regimes, making your signals smarter, more responsive, and robust to noise. Includes fully commented code, sample backtests, and a detailed PDF manual.

What’s Inside: Cutting-Edge Adaptive Filters

- Adaptive Rectified Linear Filter: A trend-following filter inspired by ReLU neural nets, reacting only to true trend moves and suppressing noise with dynamic sensitivity.

- Adaptive Savitzky–Golay Filter: Classic smoothing, but with window and polynomial order that auto-tune to current volatility—preserves price features while taming noise.

- Dynamic Wavelet-Filter Hybrid: Combines wavelet decomposition with adaptive smoothing to capture both fast and slow market cycles for highly responsive trend signals.

- FRAMA (Fractal Adaptive Moving Average): The renowned fractal math-based moving average—accelerates in trends, brakes in chop, using local fractal dimension.

- Gopalakrishnan RAVI-Driven Filter: Uses the Range Action Verification Index to drive adaptive filtering—locks in during trends, loosens up in ranging conditions.

- Kalman-Noise-Adaptive Trend Filter: State-space Kalman filter that recalibrates noise in real time for ultra-robust trend tracking.

- Spectral-Slope Adaptive Filter: Reads the “spectral slope” (energy distribution) of price and adapts filter speed accordingly—fast in trends, steady in chop.

- Time-Decay Adaptive Exponential MA: Exponential moving average with a decay rate that adjusts to market volatility for smarter, more responsive smoothing.

- VIDYA (Variable Index Dynamic Average): A dynamic average whose smoothing adapts to the ratio of short-term to long-term volatility—auto-adjusts to market regime.

- Volume-Weighted Adaptive EMA: EMA that changes its smoothing based on market volume—new information gets prioritized, old data fades in quiet markets.

What You Get

- Full Python source code (

.pyformat) - Sample backtests and data for each filter

- PDF manual explaining logic, parameters, and usage

How It Works

Import any filter, plug in your price series, and run as a stand-alone signal, trend detector, or custom input for your models. Compatible with Backtrader, vectorbt, and other Python trading frameworks.

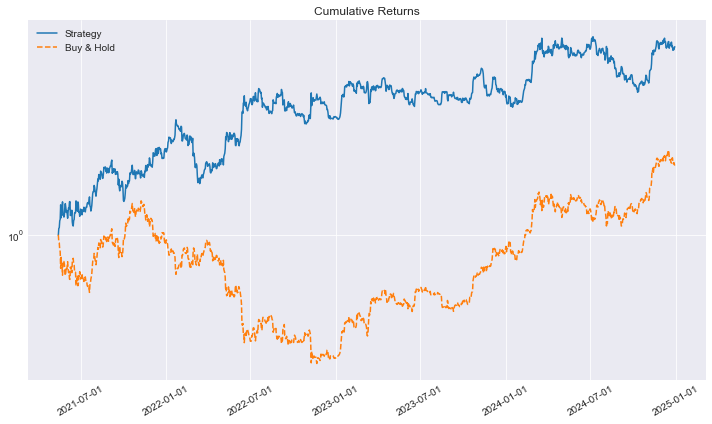

Performance Snapshots

Sample metrics for selected filters on BTC-USD (actual results will depend on asset and parameters):

- --- FRAMA_H Strategy ---

- Cumulative: 5.39x

- Ann. Ret: 63.51%

- Ann. Vol: 58.55%

- Sharpe: 1.08

Documentation & Support

- PDF manual for all 10 strategies (download)

- Ongoing code updates and email support

Get the Adaptive Filter Strategy Pack Now

Download instantly and power up your signal processing edge. Lifetime updates and direct support included.

Purchase Now!